If you were sick or injured and couldn’t work for a while, you’d want to feel safe and secure at home.

Unfortunately, many Americans may not be able to pay their everyday expenses in this scenario. They might not be able to afford rent or a mortgage.

That’s where individual disability insurance comes in. “We generally think to protect our families and belongings through health, life, auto, and homeowners insurance, but we rarely think to protect our income stream,” says Stanley Poorman, a financial professional with Principal® . “It’s important to review your disability insurance coverage to make sure you have enough in place to cover your needs should you not be able to work and generate income.”

Learn how disability insurance can help when you need it most with answers to five frequently asked questions:

1. Why do I need individual disability insurance?

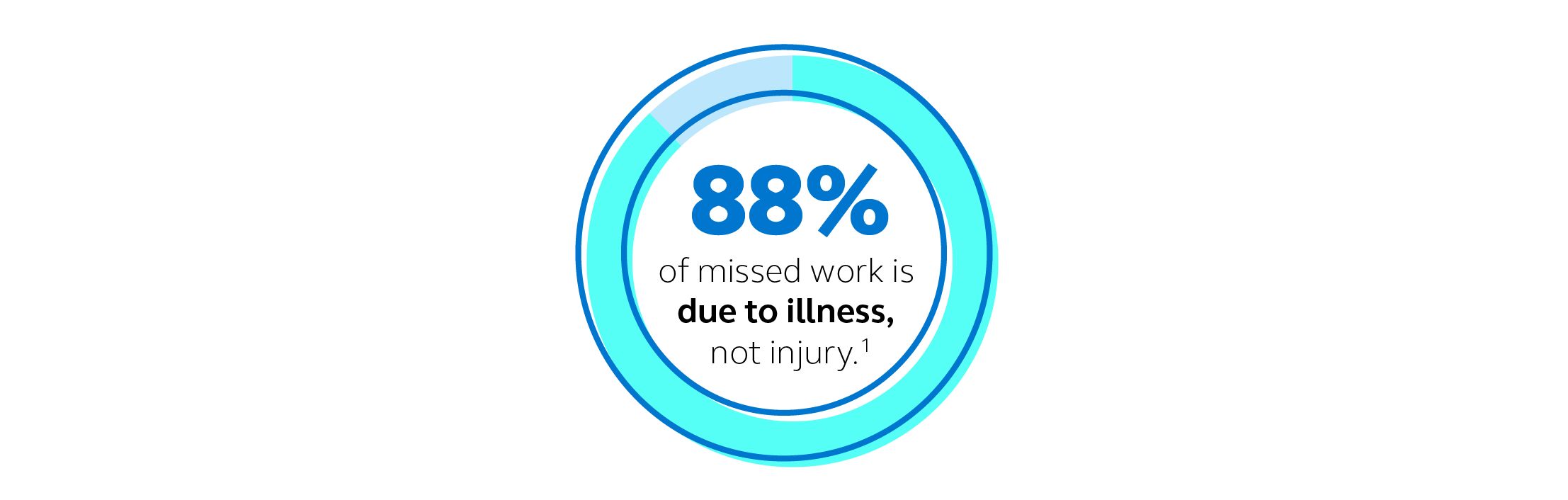

Because you’re human. Getting it after you’re sick or injured is too late. Maybe you’re thinking about the statistics of traffic accidents or whether you’re likely to break a bone while dominating the ski slopes. But the most common reason people can’t work is illness, not injury1—diagnoses like cancer, bipolar disorder, and arthritis.

2. What does disability insurance cover?

Your lifestyle. Think of all the monthly expenses you take for granted because they’re routinely supported by your income: health-care costs, daycare, or your mortgage. Disability insurance helps you maintain your household and afford the time and mental space to heal as you handle a medical challenge.

3. How much disability insurance do I need?

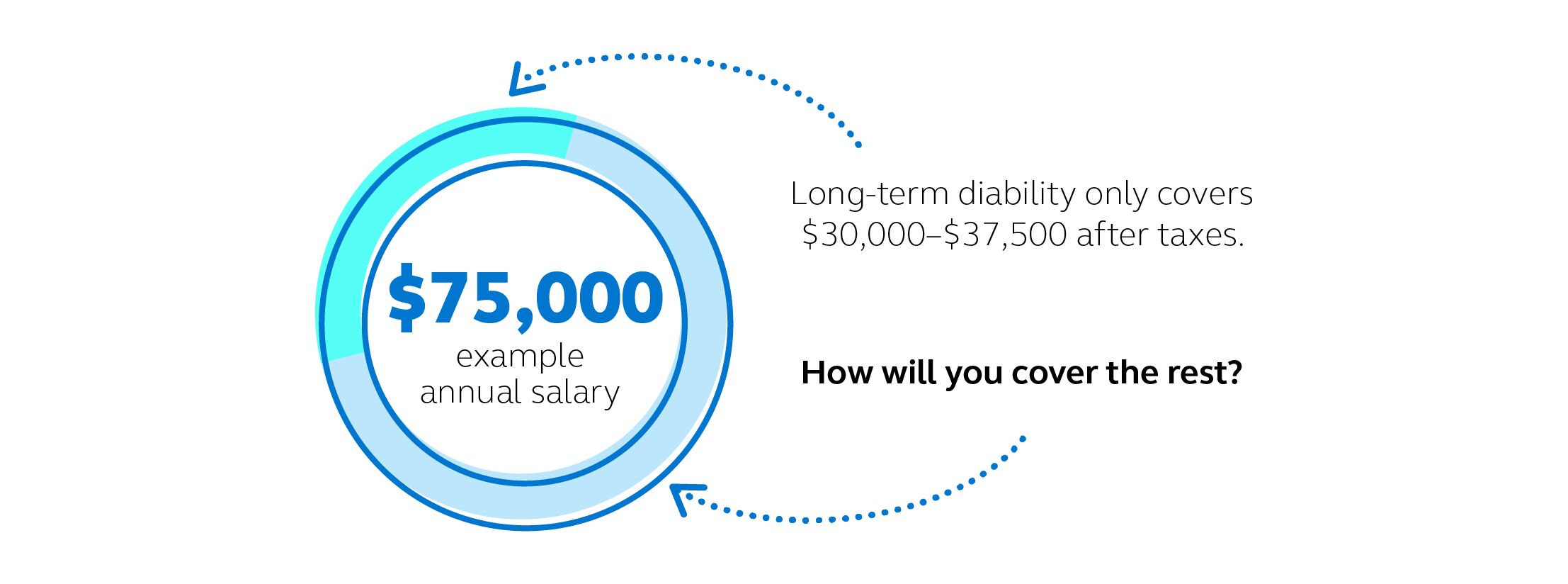

If you have group long-term disability (LTD) insurance through work, that’s a great start. But it may not be enough to cover your expenses.

Most LTD will cover about 60% of your income; after taxes that could be down to 40–50% of your income. Ask your human resources rep for specifics. Supplemental disability insurance could help replace more of your monthly income to keep you solvent and stable.

“A quick way to determine if you have enough is to review your monthly budget—thinking about what’s necessary and what expenses could be cut,” Poorman says. “From there, you should have a good idea of how much of your income needs to be replaced.”

Use our online disability insurance calculator to find out how much you might need to protect your lifestyle.

4. How much does disability insurance cost?

Not much—typically 1–3% of what you earn. Poorman suggests looking to your monthly budget to determine how much you’re comfortable spending. Then get an estimate.

It’s easy: You’ll answer questions that help describe your health habits, job/income status, other insurance coverage, and medical history. “If necessary, consider any tradeoffs you’re willing to make in your budget to cover any gaps,” Poorman says.

5. When is the best time to get disability insurance?

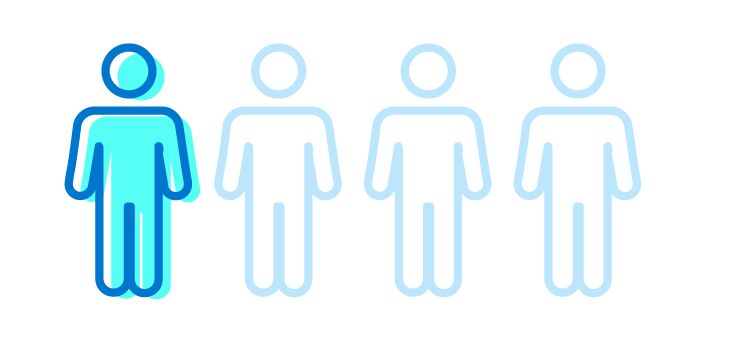

Now. No one can foresee if or when a disability will prevent them from working. But here’s a staggering statistic: More than one in four of today’s 20-year-olds will face disability before they reach traditional retirement age, according to the Social Security Administration. 2

“There's no time like the present,” says Poorman. “As you get older or time goes by, rates will increase or you may no longer qualify. So start the conversation as soon as possible.”

What's next

Secure your income through disability insurance: Start here to get a quote in 5 minutes.