Achieving financial security

87% of plan sponsors agree that financial wellness programs help employees better prepare for retirement.* See how we encourage steps toward financial security by embedding education and financial wellness into our participant education resources.

Over 50% of participants are wanting to learn more about estate planning, will preparation, and investments.*

*ÑÇÖÞÎÞÂëRetirement Security Survey, June 2022.

87% of plan sponsors agree that financial wellness programs help employees better prepare for retirement.*

Easy, outcome-focused, personalized experiences

Campaign |

Timing |

Audience |

|---|---|---|

Eligibility and enrollment reminders

|

|

All newly DC eligible, including all eligible participants in transition plans, receive the get started communication Reminders only go to eligible participants not subject to automatic enrollment who have not yet enrolled |

Topics include plan benefits and services, including the Retirement Wellness Score, investment options, security, beneficiaries, and Principal® Milestones. |

Begins the day after plan entry or contract effective date and continues with a new email each week | Transitioned and newly enrolled participants |

| Annually on the plan entry or contract effective date | DC active participants who have not taken action to enroll | |

| 12 months after the last login or reminder email | Participants who have never logged in or have not logged in in 12 months |

Campaign |

Timing |

Audience |

|---|---|---|

| Annual (personalized timing) | Active DC participants with an account balance | |

| Annual (personalized timing) | Active DC participants with an account balance | |

| Multiple email touches the first year and annual reminders | Participants on existing ÑÇÖÞÎÞÂëplans that add Target My Retirement®. Excludes participants already enrolled in managed accounts | |

| Annual (personalized timing) | Active DC participants with an account balance | |

| Annual (January) | Participants age 55+ | |

| Automatically | Participants who have an employment change or retire |

Campaign |

Timing |

Audience |

|---|---|---|

| Monthly | DC participants <55, 55+ | |

| Spanish participant newsletter | Quarterly | DC Participants with Spanish as their preferred language |

| Monthly participant webinars | Monthly | Targeted based on topic with reminders sent to those who don't take action and replays sent to those who sign up |

See the experience

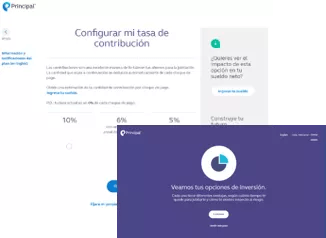

Get started with Principal® Real Start.

As they get started at Principal, individuals will encounter Principal® Real Start. Here, they will get set up with their online access and get started in their plan.

Defined contribution participants can also set up their contribution rates, select their investments, roll in eligible outside assets, elect beneficiaries, and more.

#2 ranked traditional enrollment experience with a perfect score for the beneficiary part of the process1

- Average deferral with Principal® Real Start is 2x higher compared to those who used other enrollment methods.2

- Nearly 40% of users are saving 10% or more, and 1 in 3 participants choose to auto-escalate up to 10%.2

Spanish Principal® Real Start3

- Average deferral rate is over 7%.

- More than 30% are saving at 10% or more.

- Another 1 in 3 are auto-escalating their way up to 10%.

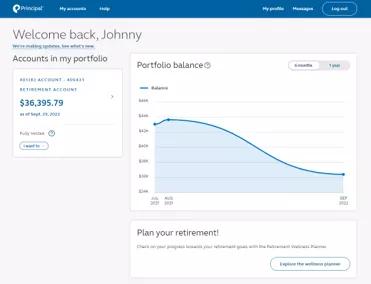

Log in and secure account on the participant website.

When a participant logs into their account, they’ll see a consolidated view of their different accounts all in one spot. From there, they can dig into their specific accounts.

From a defined contribution perspective, our participant website is the main hub for participants to learn about and make changes to their retirement accounts. On their landing page, they'll be able to quickly see their account balance, Retirement Wellness Score, and more.

For defined benefit accounts, participants can review their current benefit, and also estimate their future benefits.

Nonqualified accounts allow you to see your account balance over time along with tracking recent distributions and contributions.

- Award-winning participant website and online capabilities1 and mobile communications2.

- Silver for participant website educational resources.3

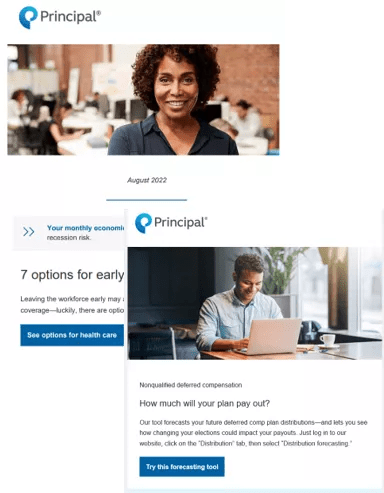

Understand plan information.

Participants can learn about their plans through various touchpoints. For DC, DB, and NQ participants, the timely financial wellness newsletters provide topical educational information along with education about their plans. ESOP resources will be coming soon.

Helping Hispanic employees feel more financially secure.

Support Hispanic workers with distinct tools and transcreated resources—not just translated—that reach and educate participants in a matter that’s culturally relevant.

- Transcreated webinars

- Budgeting resources

- Account security information

- Fliers and handouts

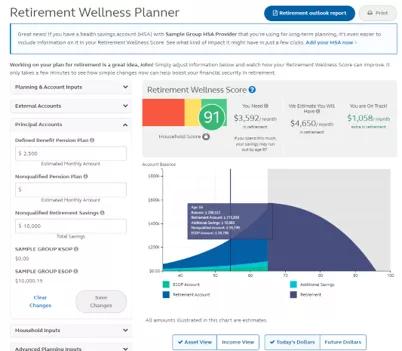

See if you're on track for retirement.

This robust planner gives participants a holistic picture of their retirement readiness, helping them find out how much income they may need in retirement and whether they’re currently saving enough to meet that need.

- Your participants can check their retirement wellness planner and score.

- 40% higher average deferral among participants who use our digital resources.1

Download the Principal® app.

The Principal® app is streamlined for convenience and speed. It puts participants in control—getting them the answers they want quickly and letting them make changes efficiently. It’s all about helping them plan for the future while helping them get back to living their lives as quickly as possible.

Available in English and Spanish

- 4.8 star rating - Apple - 75% of our user base on iOS1

- 4.6 star rating - Google Play1

- 3.71% average deferral increase for 401(k) participants2

Elevating the financial wellness experience.

Our financial wellness experiences work alongside and together with our education experiences. We understand that as a participant arrives at certain points in their life, their needs may change. Some may need retirement education resources, while others are looking to elevate their experience with financial wellness.

That’s why we have easy, personalized education and financial wellness experiences that drive engagement and promote outcomes along the way.

- Participants can learn about the financial topics that matter most to them.

- 44% higher average deferral among 401(k) participants who use Principal® Milestones.1

Get ready for retirement.

We understand that as they get closer to retirement, participants have a number of questions for what their next steps will bring. Our Retirement Transition Program and Benefit Event Experiences help participants through these life transitions.

- Use the Retirement Transition Program.

- Learn about distribution options through the Benefit Event Experience.

Elevating financial wellness

Our monthly webinar series—30 minutes with live Q&A, plus on-demand replays—helps individuals elevate their financial wellness with helpful tips and strategies on important financial topics.

2025 topics

January

Retirement readiness: Planning tips for every stage of your career

February

Social Security planning for couples

March

Maximize your 401(k): Essential tips for saving

April

Fresh start finances: Your roadmap to balancing debt and saving

May

Staying the course: Navigating market ups and downs

June

How to navigate retirement while paying for college

July

Expand your retirment savings: Making the most of your investment acccounts

August

Credit savvy: Strategies for better credit and debt management

September

Money moves: Smart steps for a bright future

October

Essential tips to prepare for health care costs in retirement

November

Navigating Social Security: What do you need to know for 2026

December

Plan ahead: The essentials of estate planning for everyone

Quarterly Spanish webinars

Q1 Financial checkup: Building smart money habits

Q2 Staying the course: Navigating market ups and downs

Q3 5 ways you can save for retirement today

Q4 Health care in retirement

Continue learning about the .